Bitcoin Exchanges Unveil Hard Fork Contingency Plan

Stan Higgins (

@mpmcsweeney) | Published on March 17, 2017 at 16:01 GMT News

A group of nearly 20 exchanges has released contingency plans in the event that the bitcoin network splits in two, creating two competing currencies.

The exchanges are now planning to list

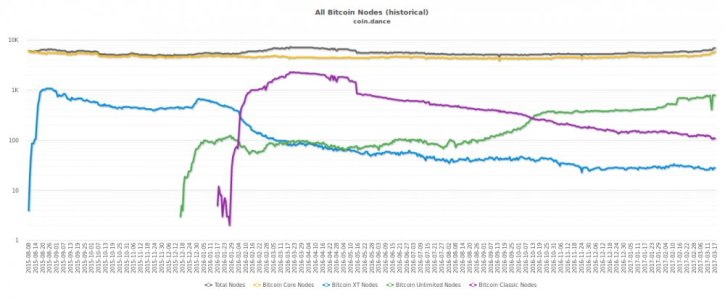

Bitcoin Unlimited (BU) as they would an alternative cryptocurrency, according to the statement. BU is an alternate implementation of the bitcoin software that seeks to expand the block size in an effort to scale the network's capacity.

According to the statement – backed by Bitfinex, Bitstamp, BTCC, Bitso, Bitsquare, Bitonic, Bitbank, Coinfloor, Coincheck, itBit, QuadrigaCX, Bitt, Bittrex, Kraken, Ripio, ShapeShift, The Rock Trading and Zaif – the exchanges would list the BU asset under the BTU or XBU tickers in the event of a network split, which they collectively say "may be inevitable".

Other exchanges, though not listed as signatories, are said to be planning similar steps but have not signed on to this particular statement.

The strategy’s emergence comes

amid escalating tension among those advocating for different scaling directions, and signals that some are taking the prospect of a network split seriously. It also follows statements from some in the exchange sector that preparations for such an outcome are being made.

The exchanges have positioned the policy choices as practical rather than political in nature. To the group, the strategy provides a means to organize a steady-handed market transition, one in which two currencies emerge that share twin transaction histories – and in which bitcoin holders are suddenly in possession of twice the amount of coins they had before.

The exchanges said:

"As exchanges, we have a responsibility to maintain orderly markets that trade continuously 24/7/365. It is incumbent upon us to support a coherent, orderly and industry-wide approach to preparing for and responding to a contentious hard fork. In the case of a bitcoin hard fork, we cannot suspend operations and wait for a winner to emerge."

Call for replay protection

Yet the statement reveals that the signatories aren’t ready to immediately start listing BU as a tradable asset, should it be created.

A major concern among the signatories is the risk of

transaction replays, or instances in which a transaction broadcast on one blockchain might be included on a second one unintentionally. This situation played out in the wake of

the ethereum network split last year.

According to the statement, exchanges want to see BU account for this risk ahead of any hard fork.

"However, none of the undersigned can list BTU unless we can run

both [blockchains] independently without incident. Consequently, we insist that the Bitcoin Unlimited community (or any other consensus breaking implementation) build in strong two-way replay protection," the group said. "Failure to do so will impede our ability to preserve BTU for customers and will either delay or outright preclude the listing of BTU."

The exchanges also solicited input from stakeholders as they put contingency plans in motion.

"We welcome any and all assistance that the development community may offer in reducing the risk inherent with such a pivotal moment in bitcoin's history," according to the statement.

The full statement can be found below:

Hardfork Statement 3.17 11.00am by Pete Rizzo on Scribd

I am setting tight stops under the support line to sleep peacefully

I am setting tight stops under the support line to sleep peacefully