Risks of Inverse Bond Funds

Inverse ETPs provide investors with a greater number of options, but also a greater number of potential dangers. First, betting against a particular market segment is, by its nature, a sophisticated strategy that may not be appropriate for all investors. Before buying such a product – and in particular one of the leveraged funds – be sure to assess your risk tolerance and make sure you understand that inverse ETFs are designed to be short-term trading vehicles.

Also, don’t forget that although they are bond funds, the leveraged versions are highly volatile in nature. For example, in the interval from July 25 to September 22, 2011, the yield on the 10-year Treasury note fell from 3.00% to 1.72% as its price rose. During that same interval, the price of Daily 7-10 Year Treasury Bear 3x Shares (ticker: TYO), a triple-inverse ETN, fell from $38.23 to $28.02 – a loss of 26.7%. Make sure you can tolerate this type of volatility before you invest.

Risks of Double and Triple Inverse Bond Funds

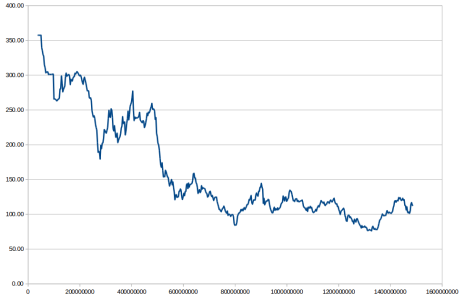

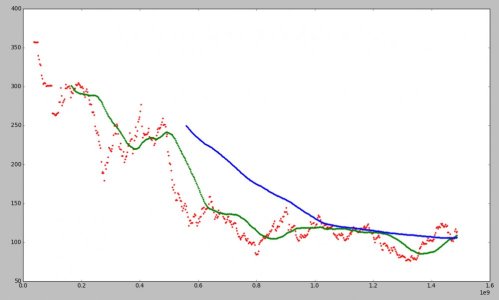

Investors also should be aware that the two- and three-times inverse funds only provide the expected inverse performance on single days. Over time, the effect of compounding means that investors won’t see performance that is exactly two or three times the opposite of the index. In fact, the longer the time period, the greater the divergence between actual and expected returns.

A quick example: in a single day, an inverse Treasury ETF might lose 2% if the market rises 1%. It lost one third of its value during its just over five years in existence and rarely went up.

Over a month, the return might be -6% (not -4%) on a 2% loss for the market. In a year, an investor may see a -26% (not -20%) loss on a 10% downturn in the market. This is only a hypothetical, but it illustrates the divergence that can occur over time. This is the most important reason why the leveraged inverse funds shouldn’t be considered long-term investments.