You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

DJIA, NYSE, S&P = CRASH!!!

- Thread starter presence

- Start date

TheCount

Member

- Joined

- Mar 15, 2014

- Messages

- 11,744

Well duh - sell on rumor, buy on news. That's how it works.

But it closed up ahead of the vote in anticipation of a positive remain vote. This is just a small correction. 2-3% is not the end of the world. 2007 - 2008 = we lost 50%. And even then, the only thing that was required in order not to take a loss was to sit tight.

That won't be what's advertised on the net, though... it'll be peak to trough worse case numbers used to argue the end of the world. By Zerohedge, undoubtedly.

angelatc

Member

- Joined

- May 15, 2007

- Messages

- 50,703

That won't be what's advertised on the net, though... it'll be peak to trough worse case numbers used to argue the end of the world. By Zerohedge, undoubtedly.

It never is. Same thing with the housing crash. Unless you're selling, the market value of your home is not really relevant on a daily basis. But nobody watches the news to hear someone say, "Just hang out - it'll work itself out."

I'm making so much money today.

Me too . best day since May .

TheCount

Member

- Joined

- Mar 15, 2014

- Messages

- 11,744

It never is. Same thing with the housing crash. Unless you're selling, the market value of your home is not really relevant on a daily basis. But nobody watches the news to hear someone say, "Just hang out - it'll work itself out."

I don't think that it has much to do with the news... or rather, I think that the news is the symptom rather than the cause... they're reporting what their audience wants to hear.

I think that Americans, generally, value people in terms of their dollar worth, and as such they're highly concerned with how much money they, personally, are worth at any given moment. A rise or fall in the dollar price of their investments or home or whatever has an immediate impact on their opinion of themselves, despite the fact that the actual value of those things has not changed - and despite the fact that the value or price of those things has absolutely no bearing whatsoever on their worth as a person.

BTFD BEEEYACHES

I'd consider a btfd for a decent tuesday bounce but not for monday. Gonna be a lot of sell orders lined up over the weekend.

Me too . best day since May .

Must be shorting than.

Not me.Tesla has had some big fans on this forum

presence

Member

- Joined

- Dec 20, 2011

- Messages

- 19,330

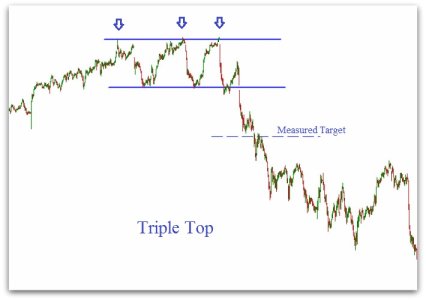

http://www.investopedia.com/terms/t/tripletop.asp

sub 14000 is destiny

Last edited:

jllundqu

Member

- Joined

- May 24, 2011

- Messages

- 7,304

ohhhhohohohhhh CHart porn

Danke

Top Rated Influencer

- Joined

- Nov 6, 2007

- Messages

- 44,263

Who wants to bet that the insiders and banks are dumping equity holdings while the ESF/PPT is running overdrive printing the loot to buy them up? Doesn't look like a coincidence that banks are announcing big stock buybacks of their own stock right after this highly improbable rally. After the insiders are out and the banks have completed their own buybacks, the ESF (taxpayers) will be on the hook holding a crap ton of (weak) stocks. That's when they let the bottom fall out. The printers are running hardcore quietly in the background to prop the markets up, hence why metals and commodities are going up. I can't remember the last time I saw every asset class going up fast at the same time.

Last edited:

Zippyjuan

Banned

- Joined

- Feb 5, 2008

- Messages

- 49,008

Brexit drop over? http://www.cnbc.com/2016/06/29/us-markets.html

That was yesterday. Up another 200 points with a hour to go today. Almost all the way up to where it was just before the vote took place.

Dow closes up more than 250 points, recovers more than half of Brexit losses

U.S. stocks closed more than 1.5 percent higher Wednesday, helped by gains in oil prices, as global markets recovered for a second day from their post-Brexit plunge.

"What I think people are grasping here is, this is a disaster for the U.K., but it's a big splash with small ripples," said David Kelly, chief global strategist at JPMorgan Funds.

The Dow Jones industrial average closed up nearly 285 points in its best percentage gain since March 1, with Boeing and Goldman Sachs contributing the most to gains as all constituents except Home Depot rose.

That was yesterday. Up another 200 points with a hour to go today. Almost all the way up to where it was just before the vote took place.

Madison320

Member

- Joined

- Jan 11, 2012

- Messages

- 6,032

Brexit drop over? http://www.cnbc.com/2016/06/29/us-markets.html

That was yesterday. Up another 200 points with a hour to go today. Almost all the way up to where it was just before the vote took place.

Main reason: Brexit = No Rate Hikes (Maybe we'll even get rate cuts and QE).

Similar threads

- Replies

- 1

- Views

- 27

- Featured

- Replies

- 2

- Views

- 1K

- Replies

- 2

- Views

- 2K

- Replies

- 9

- Views

- 161