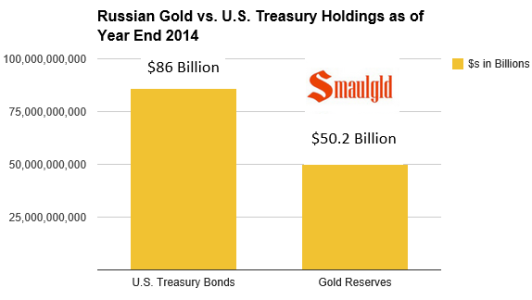

Last month we showed how Russia had been decreasing its holdings in U.S. Treasuries while increasing its gold reserves.

We showed Russia's US Treasury holdings as of November 2014 and their gold holdings as of December 2014.

The U.S. Treasury reported today that Russia has reduced its U.S. Treasury holdings to $86 Billion in December from $108 Billion in November.

Later this month Russia will release its gold holdings as of January 2015.

https://smaulgld.com/foreign-holdings-u-s-treasuries/

We showed Russia's US Treasury holdings as of November 2014 and their gold holdings as of December 2014.

The U.S. Treasury reported today that Russia has reduced its U.S. Treasury holdings to $86 Billion in December from $108 Billion in November.

Later this month Russia will release its gold holdings as of January 2015.

https://smaulgld.com/foreign-holdings-u-s-treasuries/